SECURITIES AND EXCHANGE COMMISSION

Proxy Statement Pursuant to Section 14(a) of the Securities

| Filed by the Registrant | ☒ý |

| Filed by a Party other than the Registrant | ☐ |

Check the appropriate box:

☐ | |

| Preliminary Proxy Statement |

| ☐ | Confidential, for Use of the Commission Only (as permitted by Rule 14c-6(e)(2)) |

| ☒ | Definitive Proxy Statement |

| ☐ | Definitive Additional Materials |

| ☐ | Soliciting Material Pursuant to § 240.14a-12 |

(Name of Registrant as Specified in its Charter)

(Name of Person(s) Filing Proxy Statement if other than the Registrant)

Payment of Filing Fee (Check the appropriate box)

| ☐ | Fee computed on table below per Exchange Act Rules 14a-6(i)(4) and 0-11. |

| (1) | | Title of each class of securities to which transaction applies: |

| (2) | | Aggregate number of securities to which transaction applies: |

| (3) | | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): |

| (4) | | Proposed maximum aggregate value of transaction: |

| ☐ | Fee paid previously with preliminary materials. |

| ☐ | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

☐ | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

| (1) | | Amount Previously Paid: |

| (2) | | Form, Schedule or Registration Statement No.: |

![[ACCO BRANDS]](https://capedge.com/proxy/DEF 14A/0001626129-17-000136/accodef051017001.jpg)

March 28, 2017

We invite you to join the Board of Directors and our management team at the ACCO Brands Corporation

20172019 Annual Meeting of Stockholders, which will be held at

10:309:00 a.m. (Central Time) on Tuesday, May

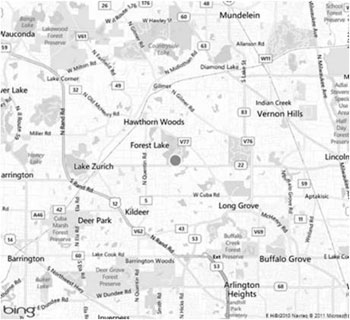

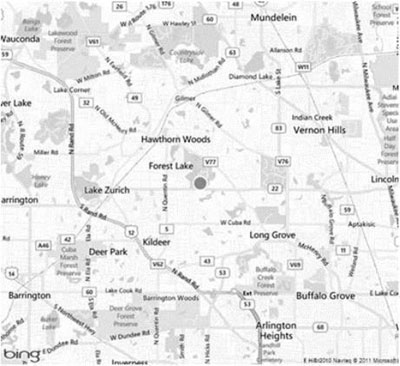

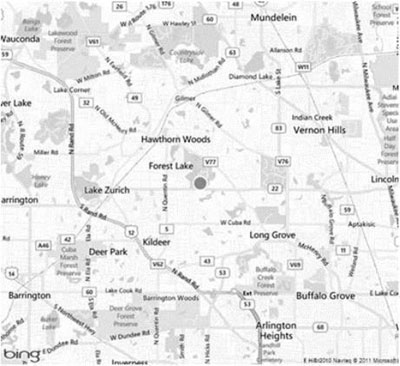

16, 201721, 2019 at the Kemper Lakes Business Center, Three Corporate Drive, Lake Zurich, Illinois. A map with directions to the Kemper Lakes Business Center can be found at the end of the attached Proxy Statement. The sole purpose of the meeting is to consider the matters described in the following Notice of

20172019 Annual Meeting and Proxy Statement.

2016 was

Over the last several years we have been shifting our business through organic initiatives and acquisitions toward stronger brands, more value-added products, faster-growing geographies, and a great year formore diversified customer base. We have complemented these investments with ongoing cost reductions and productivity improvement initiatives. We have been disciplined stewards of shareholder capital, controlling what we can, reacting appropriately to industry changes, and investing accretively to reorient our business towards sustainable profitable growth.

As a result, we have been able to grow our operating cash flow from $172 million in 2014 to $195 million in 2018, and we have returned some of this cash to our shareholders, initiating a share repurchase program in 2014 and a dividend last year. In total, we have returned $216 million to shareholders over the last 4 ½ years, including $100 million in 2018.

In 2018, ACCO Brands net sales decreased modestly to $1.94 billion from $1.95 billion in 2017, and its stockholders. We met or exceeded nearly every operational oroverall our financial objective that we had setresults were mixed, especially when compared to the historically successful 2017. Sales growth in our EMEA segment continued on the strength of our 2017 acquisition of Esselte. Sales in Brazil and Canada improved as well due to the strength of our brands particularly during back-to-school seasons. These improvements were not enough to offset declines in Australia, Mexico and especially the U.S. due to changes in local channel dynamics.

Our performance in the U.S. was particularly disappointing. As the wholesaler channels pursued alternative routes to consolidation, their preparations for

sale and related market uncertainty caused significant channel inventory reductions during the year.

EachThis contributed 4% of

our business segments contributed to revenue growth or profit improvement. We gained share with key customers and in strategic categories, increased operating margins, generated significant free cash flow, and strengthened our balance sheet. We announced two acquisitions, including Pelikan Artline in Australia, completed May 2, 2016, and Esselte in Europe, completed January 31, 2017. Both present excellent opportunities for consumer, customer and stockholder value creationan overall 7% sales decline in the

yearsU.S. In addition, our profitability was impacted by major cost increases in raw materials, fuel, transportation and logistics, as well as the imposition of incremental tariffs on goods imported from China. While we implemented price increases in the second half of the year, they were not enough to

come.fully offset the magnitude of the cost increases.

We believe

the significant decline in sales to wholesalers which we experienced in 2018 will not be sustained in 2019. In addition, we are actively marketing to independent U.S. dealers to buy directly from us. We also raised our

operating successprices again in early 2019 to account for all known cost inflation, including tariffs. Finally, we are aggressively reducing structural costs in our U.S. business. We expect these and

strategic accomplishments during the year were well recognized by the market - our stock price was up 83%other actions will deliver improved profitability in

2016 and 94% over the three year period ending December 31, 2016.For 2017, our strategy remains consistent. 2019.

We

will continue to manage our mature markets, categories and channels for profit. We will maintain our commitment and rigor around execution and productivity initiatives, including delivering on integration and synergies for the two acquisitions. We will prudently invest in emerging markets, new channels and new products with an expectation for top and bottom line growth. And, as always, we will focus on generating strong cash flow. We remain confident thatbelieve we have the right strategy

for our company. Despite a challenging year in 2018, we remain confident about our future and

management teamcontinue to

increase the long-term value of our Company.position ACCO Brands for profitable growth and increasing shareholder value.

It is important that your shares are represented at the meeting, whether or not you plan to personally attend. You can submit your proxy by using a toll-free telephone number, by mail or through the Internet, or you can vote in person at the meeting. Instructions for using these services are provided on the accompanying proxy card. If you decide to vote your shares using the accompanying proxy card, we urge you to complete, sign, date and return it promptly.

![[BORIS ELISMAN]](https://capedge.com/proxy/DEF 14A/0001626129-17-000136/accodef051017002.jpg)  |  |  |

| | |

| Boris Elisman | Robert H. Jenkins | James A. Buzzard |

President and Chief Executive Officer | Presiding

| Lead Independent Director |

Forward-Looking Statements

Statements contained in this letter and the accompanying proxy statement, other than statements of historical fact, particularly those anticipating future financial performance, business prospects, growth, operating strategies and similar matter are “forward-looking statements” within the meaning of the Private Securities Litigation Reform Act of 1995. These statements, which are generally identifiable by the use of the words “will.” “believe,” “expect,” “intend,” “anticipate,” “estimate,” “forecast,” “project,” “plan,” and similar expressions, are subject to certain risks and uncertainties, are made as of the date hereof, and we undertake no duty or obligation to update them. Because actual results may differ materially from those suggested or implied by such forward-looking statements, you should not place undue reliance on them when deciding whether to buy, sell or hold the Company’s securities.

Our business outlook is based on certain assumptions, which we believe to be reasonable under the circumstances. These include, without limitation, assumptions regarding the timing, cost and synergies expected from integration of acquisitions; the impact of the recent changes in U.S. tax laws and trade policies; changes in the macro environment; fluctuations in foreign currency rates and share count; changes in the competitive landscape, including ongoing uncertainties driven by the consolidation in the traditional office products channels, and consumer behavior; as well as other factors described below.

Among the factors that could cause actual results to differ materially from our forward-looking statements are: a relatively limited number of large customers account for a significant percentage of our sales; risks associated with shifts in the channels of distribution for our products; risks associated with foreign currency fluctuations; challenges related to the highly competitive business environments in which we operate, including ongoing uncertainties driven by consolidation in the traditional office products channels; our ability to develop and market innovative products that meet consumer demands; our ability to grow profitably through acquisitions and expand our product assortment into new and adjacent categories; our ability to successfully integrate acquisitions and achieve the financial and other results anticipated at the time of acquisition, including synergies; risks associated with the changes to U.S. trade policies and regulations, including increased import tariffs and overall uncertainty surrounding international trade relations; the failure, inadequacy or interruption of our information technology systems or supporting infrastructure; risks associated with a cybersecurity incident or information security breach; our ability to successfully expand our business in emerging markets which generally expose us to greater financial, operational, regulatory and compliance and other risks; the effects of the U.S. Tax Cuts and Jobs Act; the impact of litigation or other legal proceedings; risks associated with changes in the cost or availability of raw materials, labor, transportation and other necessary supplies and services and the cost of finished goods; issues that affect consumer spending decisions during periods of economic uncertainty or weakness; the risks associated with outsourcing production of certain of our products, information systems and other administrative functions; the continued decline in the use of certain of our products; risks associated with seasonality; our failure to comply with applicable laws, rules and regulations and self-regulatory requirements and the costs of compliance; the sufficiency of investment returns on pension assets and risks related to actuarial assumptions; any impairment of our intangible assets; risks associated with our indebtedness, including our debt service obligations, limitations imposed by restrictive covenants and our ability to comply with financial ratios and tests; the bankruptcy or financial instability of our customers and suppliers; our failure to comply with customer contracts; our ability to secure, protect and maintain our intellectual property rights; product liability claims or regulatory actions; our ability to attract and retain key employees; the volatility of our stock price; material disruptions of our or our suppliers’ operations resulting from circumstances outside our control; and other risks and uncertainties described in “Part I, Item 1A. Risk Factors” in our Annual Report on Form 10-K for the year ended December 31, 2018, and in other reports we file with the SEC.

NOTICE OF

20172019 ANNUAL MEETING

The Annual Meeting of Stockholders of ACCO Brands Corporation (“ACCO Brands” or the “Company”) will be held at the Kemper Lakes Business Center, Three Corporate Drive, Lake Zurich, Illinois, 60047, at

10:309:00 a.m. Central Time on Tuesday, May

16, 2017,21, 2019, for the following purposes:

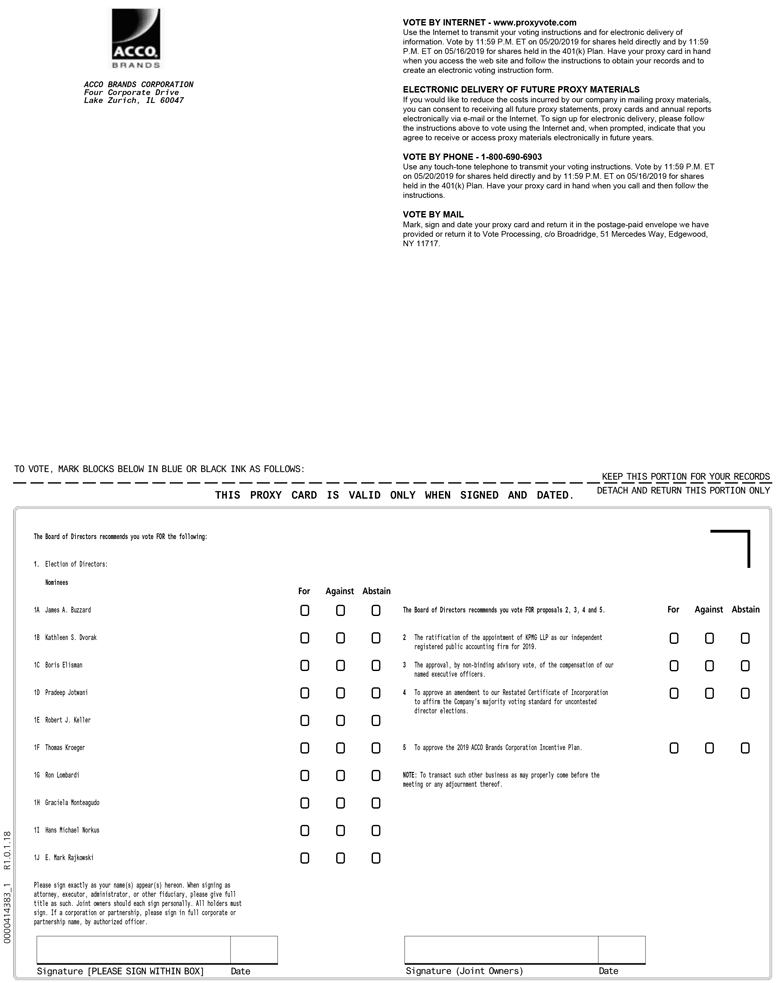

| Item 1: | To elect nineten directors identified in this Proxy Statement for a term expiring at the 20182020 Annual Meeting; |

| Item 2: | To ratify the selectionappointment of KPMG LLP as our independent registered public accounting firm for 2017;2019; |

| Item 3: | To approve, by non-binding advisory vote, the compensation of our named executive officers; |

| Item 4: | To approve by non-binding advisory vote,an amendment to our Restated Certificate of Incorporation to affirm the frequency of holding the advisory vote on the compensation of our named executive officers; andCompany’s majority voting standard for uncontested director elections; |

| Item 5: | To approve the 2019 ACCO Brands Corporation Incentive Plan; and |

| Item 6: | To transact such other business as may properly come before the meeting or any adjournment or postponement thereof. |

We currently are not aware of any other business to be brought before the

20172019 Annual Meeting (the “Annual Meeting”). Only holders of record of common stock at the close of business on March

22, 201725, 2019 will be entitled to vote at the Annual Meeting or at any adjournment or postponement thereof.

Please submit a proxy as soon as possible so that your shares can be voted at the meeting in accordance with your instructions. You may submit your proxy (1) by telephone, (2) through the Internet or (3) by mail. For specific instructions, please refer to the accompanying proxy card. If you attend the Annual Meeting, you may revoke your proxy and vote in person.

This year we are again taking advantage of Securities and Exchange Commission (“SEC”) rules that allow us to furnish proxy materials to our stockholders via the Internet. We will send a Notice of Internet Availability of Proxy Materials (the “Notice”) to holders of our common stock as of the record date on or about

March 28, 2017.April 4, 2019. The Notice describes how you can access our proxy materials, including this Proxy Statement, beginning on

March 28, 2017.or about April 4, 2019.

We also are soliciting voting instructions from participants in the ACCO Brands Corporation 401(k) plan who hold shares of our common stock under the plan. We ask each plan participant to sign, date and return the accompanying voting instruction card or provide voting instructions by telephone or through the Internet as described on the voting instruction card.

By order of the Board of Directors

Senior Vice President, General Counsel

This Proxy Statement and accompanying proxy are first being made available or distributed to our

stockholders on or about

March 28, 2017.PROXY STATEMENT - HIGHLIGHTS

This summary highlights certain information contained elsewhere in this Proxy Statement. This summary does not contain all the information you should consider. You should read the entire Proxy Statement carefully before voting.

ACCO Brands Corporation Annual Meeting of Stockholders Time and Date:10:309:00 a.m. Central Time on Tuesday, May 16, 201721, 2019 Place:Kemper Lakes Business Center, Three Corporate Drive, Lake Zurich, Illinois 60047 Record Date:March 22, 201725, 2019

Proposals to be Voted on and Board Voting Recommendations | Proposals | | Board

Recommendations | | Board Recommendations | | Page No. |

| | | | | | | |

| Item 1 | | Election of nineten directors | | FOR each nominee | | 5 |

| | | | | | | |

| Item 2 | | Ratification of the appointment of KPMG LLP as our independent registered public accounting firm for fiscal 20172019 | | FOR | | 2120 |

| | | | | | | |

| Item 3 | “Say-on-pay” | Approval, by non-binding advisory vote, onof the compensation of our named executive officers | | FOR | | 5354 |

| | | | | | | |

| Item 4 | Frequency | Approval of future advisory votes onan amendment to our Restated Certificate of Incorporation to affirm the compensationCompany’s majority voting standard for uncontested director elections | | FOR | | 55 |

| | | | | | |

| Item 5 | | Approval of our named executive officersthe 2019 ACCO Brands Corporation Incentive Plan | ANNUALLY | FOR | | 5456 |

Board of Directors and Committees

| ● | Declassified Board of Directors - all directors elected annually |

| ● | Presiding Independent Director |

| ● | 80% of our directors are independent |

| ● | Fully independent Audit Committee, Compensation Committee and Corporate Governance and Nominating Committee |

| ● | Executive sessions of non-employee directors held at each regularly scheduled quarterly board meeting |

| ● | All directors attended over 80% of Board and committee meetings held in 2016 |

Declassified Board of Directors - all directors elected annually

Lead Independent Director

90% of our directors are independent

Fully independent Audit Committee, Compensation Committee and Corporate Governance and Nominating Committee

Executive sessions of non-employee directors held at each regularly scheduled quarterly board meeting

All directors attended over 85% of Board and committee meetings held in 2018

Stockholder Interests

| ● | Majority voting standard for election of directors in uncontested elections |

| ● | No rights or “poison pill” plan |

| ● | All directors and executive officers have met or are on track to meet stock ownership guidelines |

| ● | Annual vote to ratify independent auditors |

| ● | Hedging, pledging and short sales of company stock are prohibited |

Majority voting standard for election of directors in uncontested elections

No rights or “poison pill” plan

All directors and executive officers have met or are on track to meet stock ownership guidelines

Annual vote to ratify independent auditors

Hedging, pledging and short sales of company stock are prohibited

Boris Elisman, Chairman of the Board, President and Chief Executive Officer

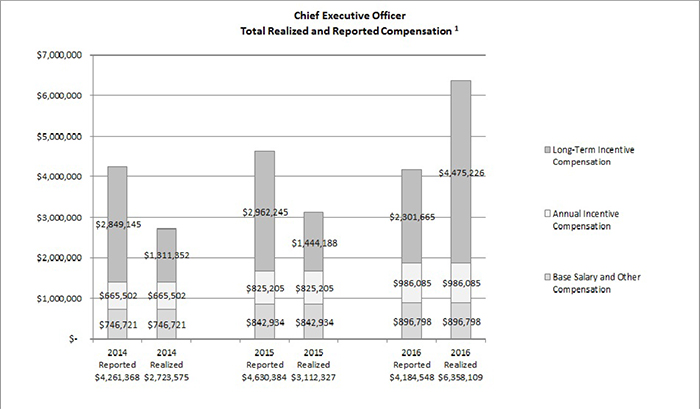

Fiscal 20162018 - Summary Compensation Table Total Realized$4,682,019

Base Salary Earnings - $945,000

2018 Annual Incentive Plan Payout - $0 (no payout due to failure to achieve annual performance goals)

2016-2018 Long-Term Incentive Plan Performance Cash Payout - $665,438 (payout driven by above target performance over the three-year performance cycle)

2018-2020 Long-Term Incentive Plan Equity Grant - $3,029,248 (represents grant date fair value)

Retirement and All Other Compensation

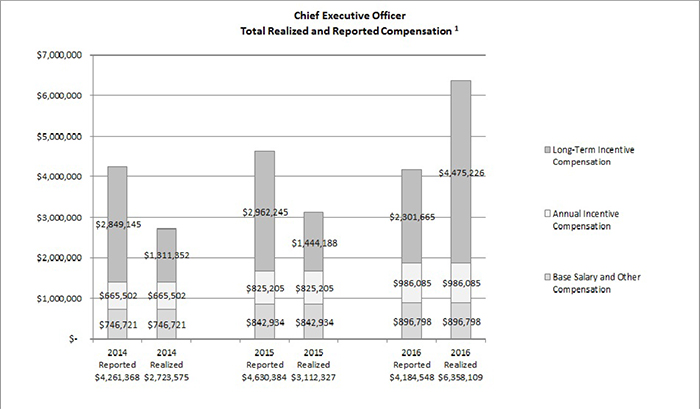

| ● | Base Salary and All Other Compensation - $896,798 |

| ● | Annual Incentive Plan Payout - $986,085 |

| ● | Long-Term Incentive Plan Performance Stock Units Payout, Restricted Stock Units Vesting, and Exercise of Stock-Settled Appreciation Rights - $4,475,226 |

- $42,333

Compensation Highlights

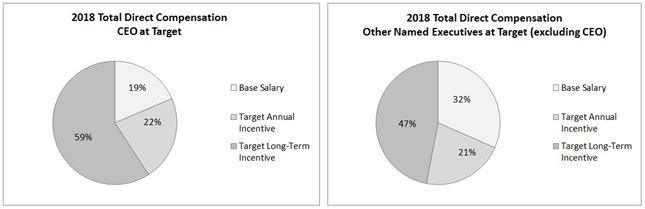

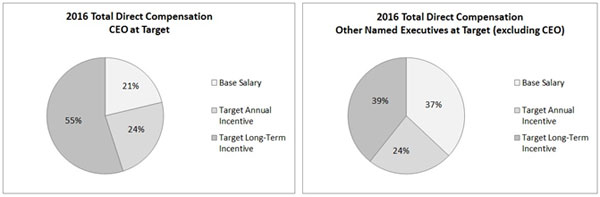

| ● | 79% of CEO target compensation is at-risk based on financial performance measures or stock price appreciation |

| ● | No executive employment agreements or individual change-in-control agreements |

| ● | Clawback and recoupment policy |

| ● | 2016 say-on-pay proposal approved by 97.0% of stockholders voting at meeting |

| ● | Independent compensation consultant |

| ● | Annual compensation risk assessment |

| ● | Three-year performance period for long-term performance-based incentive awards |

| ● | Double-trigger change-in-control provisions in executive severance plan |

| ● | Incentive compensation plan includes good corporate governance features such as: |

2018 say-on-pay proposal approved by 96.9% of stockholders voting at meeting

81% of CEO target compensation is at-risk based on financial performance measures or stock price appreciation

Effective January 1, 2019, no excise tax gross-up on executive severance plan payments

Double-trigger change-in-control provisions in executive severance plan

Three-year performance period for long-term performance-based incentive awards

Performance metrics aligned with business strategy and stockholder value creation

Incentive compensation “clawback” policy

No employment agreements for U.S.-based executive officers

Independent compensation consultant

Annual compensation risk assessment

Incentive compensation plan and practices include good corporate governance features such as:

| ○ | Double-trigger vesting of equity in event of a change-in-control |

| ○ | One-year minimum vesting with multi-year vesting requirements on equity incentives |

| ○ | No broad discretion to accelerate vesting upon events other than death or disability |

| ○ | Dividend equivalents payable only if underlying grant vests |

| ○ | No liberal share recycling provisions |

| ○ | No stock option repricing, cash buyouts, or discounted stock options |

Why is ACCO Brands distributing this Proxy Statement?

Our Board of Directors is soliciting proxies for use at the Annual Meeting to be held on Tuesday, May

16, 2017,21, 2019, beginning at

10:309:00 a.m. Central Time, at the Kemper Lakes Business Center, Three Corporate Drive, Lake Zurich, Illinois. In order to solicit your proxy, we must furnish you with this Proxy Statement, which contains information about the matters to be voted upon at the Annual Meeting.

What is the purpose of the Annual Meeting?

The purpose of the Annual Meeting is for stockholders to act upon the

following matters outlined in the Notice and described in this Proxy

Statement, including:Statement: (1) the election of

nineten directors, (2) the ratification of KPMG LLP as our independent registered public accounting firm for

2017,2019, (3) a non-binding advisory vote on the compensation of our named executive officers, (4)

a non-binding advisory vote on the

frequencyapproval of

holding an

advisory vote onamendment to our Restated Certificate of Incorporation to affirm the

compensationCompany’s majority voting standard for uncontested director elections, (5) the approval of

our named executive officers,the 2019 ACCO Brands Corporation Incentive Plan, and

(5)(6) such other business as may properly come before the meeting or any adjournment or postponement thereof. In addition, management will be available to respond to questions from stockholders.

Why did I receive a Notice in the mail regarding the availability of proxy materials on the Internet instead of a full set of proxy materials?

Pursuant to rules adopted by the SEC, we are providing access to our proxy materials via the Internet. The Notice we sent to our stockholders provides instructions on how to access and review this Proxy Statement and our Annual Report online, as well as how to vote online. Providing proxy materials electronically significantly reduces the printing and mailing costs associated with the distribution of printed copies of our proxy materials to our stockholders.

If you receive a Notice, you will not receive a printed copy of the proxy materials by mail unless you request one. All stockholders have the ability to access the proxy materials on the website referred to in the Notice or request a printed set of the proxy materials. Instructions on how to access the proxy materials over the Internet or to request printed copies may be found in the Notice. In addition, stockholders may request proxy materials in printed form by mail on an ongoing basis.

Only stockholders who own ACCO Brands common stock of record at the close of business on March

22, 201725, 2019 are entitled to vote. Each holder of common stock is entitled to one vote per share. There were

109,510,800102,621,190 shares of common stock outstanding on March

22, 2017.25, 2019.

What is the difference between being a record holder and holding shares in street name?

A record holder holds shares in his or her own name. Shares held in “street name” are shares that are held in the name of a bank, broker or other nominee on a person’s behalf. If the shares you own are held in “street name,” the bank, broker or other nominee will vote your shares according to your instructions. Under the rules of the New York Stock Exchange (“NYSE”), if you do not give instructions to your bank, broker or other nominee, it will still be able to vote your shares on any “discretionary” items but will not be allowed to vote your shares with respect to

certainany “non-discretionary” items.

Only the ratification of KPMG LLP as our independent registered public accounting firm (proxy(Proxy Item 2) is considered to be a discretionary item under the NYSE rules, and your bank, broker or other nominee will be able to vote on that item even if it does not receive voting instructions from you, so long as it holds your shares in its name.The election of directors (proxy(Proxy Item 1), the advisory vote on the compensation of our named executive officers (proxy(Proxy Item 3), the approval of the amendment to our Restated Certificate of Incorporation (Proxy Item 4), and the advisory vote onapproval of the frequency of holding an advisory vote on the compensation of our named executive officers (proxy2019 ACCO Brands Corporation Incentive Plan (Proxy Item 4)5) are non-discretionary items. Therefore, if you hold your shares in “street name”,name,” your bank, broker or other nominee may not vote your shares with respect to these items unless it receives your voting instructions.Non-discretionary proxy items as to which no voting instructions are received are counted as “broker non-votes.” Broker non-votes are shares that are held in “street name” by a bank, broker or other nominee that indicates on its proxy that it does not have or did not exercise discretionary authority to vote on a particular matter.

Stockholders of record can vote by filling out the accompanying proxy card and returning it as instructed on the proxy card. You can also vote by telephone or through the Internet by following the instructions printed on the proxy card or the Notice. You may also vote in person at the meeting.

Stockholders who hold shares in “street name” can vote by following the voting instructions in the materials received from

yourtheir bank, broker or other nominee. The availability of telephone and Internet voting for stockholders who hold shares in “street name” will depend on the voting processes of your bank, broker or other nominee. Therefore, we recommend that you follow the voting instructions in the materials you receive from your bank, broker or other nominee. In addition, you may only vote in person if you obtain a signed proxy from your bank, broker or other nominee, who is the holder of record.

How will my proxy be voted?

Your proxy, when properly signed and returned, or processed by telephone or through the Internet, and not revoked, will be voted in accordance with your instructions. We are not aware of any other matter that may be properly presented

at the Annual Meeting other than the election of directors, the ratification of the appointment of KPMG LLP as our independent registered public accounting firm for

2017,2019, the advisory vote on the compensation of our named executive officers,

the approval of the amendment to the Company’s Restated Certificate of Incorporation, and the

advisory vote onapproval of the

frequency of holding an advisory vote on the compensation of our named executive officers.2019 ACCO Brands Corporation Incentive Plan. If any other matter is properly presented at the meeting, the persons named in the enclosed form of proxy will have the authority to vote on such matters at their discretion.

What constitutes a quorum?

The holders of a majority of the issued and outstanding common stock of the Company present either in person or by proxy at the Annual Meeting will constitute a quorum. Proxies received but marked as abstentions and broker non-votes will be included in the calculation of the number of shares considered to be present at the Annual Meeting. If less than a majority of the outstanding shares of common stock are represented at the Annual Meeting, a majority of the shares so represented may adjourn the Annual Meeting to another date, time or place.

What if I

submit but don’t mark the boxes on my proxy or voting instruction?

If you hold shares in your name

unless you give other instructions onand sign and return your

form of proxy, or

when you cast your proxy by telephone or through the Internet,

but do not specify how you want your shares to be voted, the persons named as proxies will vote in accordance with the recommendations of the Board of Directors. In summary, the Board of Directors recommends a vote:

| ● | FOR the election of each director nominee (proxy Item 1); |

| ● | FOR the ratification of the appointment of KPMG LLP as our independent registered public accounting firm for 2017 (proxy Item 2); |

| ● | FOR the approval, on an advisory non-binding basis, of the compensation of our named executive officers (proxy Item 3) and |

| ● | FOR a frequency of EVERY YEAR for future advisory votes on the compensation of our named executive officers (proxy Item 4) |

FOR the election of each director nominee (Proxy Item 1);

FOR the ratification of the appointment of KPMG LLP as our independent registered public accounting firm for 2019 (Proxy Item 2);

FOR the approval, on an advisory non-binding basis, of the compensation of our named executive officers (Proxy Item 3);

FOR the approval of an amendment to our Restated Certificate of Incorporation to affirm the Company’s majority voting standard for uncontested director elections (Proxy Item 4); and

FOR the approval of the 2019 ACCO Brands Corporation Incentive Plan (Proxy Item 5)

If you hold shares in “street name,” your bank, broker or other nominee cannot vote your shares on non-discretionary items to be brought for a vote at the Annual Meeting. As a result, if you do not provide instructions

on how you want your shares to be voted, your bank, broker or other nominee will not have the authority to vote on

any proxy

Item 1 (election of directors), proxy Item 3 (advisory vote on the compensation of our named executive officers), and proxy Item 4 (advisory vote on the frequency of holding an advisory vote on the compensation of our named executive officers), but will have the authority to vote on proxyitem except Proxy Item 2 (ratification of independent auditors).

Can I go to the Annual Meeting if I vote by proxy?

Yes. Attending the meeting does not revoke your proxy unless you vote in person at the meeting.

Please note that attendance at the Annual Meeting is limited to stockholders of record as of the close of business on March

22, 2017,25, 2019, the record date, and to those who hold a valid proxy from a stockholder of record. Each stockholder and proxyholder may be asked to present valid picture identification, such as a driver’s license or passport, and proof of stock ownership as of the record date. Proof of ownership can be the Notice, your proxy card or a proxy or voting instruction card provided by your broker,

bank or other nominee, or a brokerage statement or letter from your bank or broker evidencing your ownership of ACCO Brands stock as of March 22, 2017.25, 2019. The use of cell phones, smartphones, electronic tablets, laptops, and recording and photographic equipment is not permitted in the meeting room at the Annual Meeting. Failure to follow the meeting rules will be grounds for exclusion from the Annual Meeting.

How can I revoke my proxy?

You may revoke your proxy at any time before it is actually voted by giving written notice to the secretary of the Annual Meeting (if you attend the Annual Meeting) or by delivering a later-dated proxy, which automatically revokes your earlier proxy, either by mail, by telephone or through the Internet, if one of those methods was used for your initial proxy submission. If shares are held in a stock brokerage account or by a bank, broker or other nominee, then you are not the record holder of your shares, and while you are welcome to attend the Annual Meeting you will not be permitted to vote unless you obtain a signed proxy from your bank, broker or other nominee (who is the holder of record).

No. As a matter of policy, stockholder proxies, ballots and tabulations that identify individual stockholders are kept secret and are only available to the independent Inspector of Election and certain employees who have an obligation to keep your votes secret.

How many votes are needed to elect directors and how will votes be counted?

Each nominee for director will be elected to the Board of Directors

(proxy(Proxy Item 1) if the votes cast for such nominee’s election exceeds the votes cast against such nominee’s election (with abstentions and broker non-votes not counted as a vote cast for or against that nominee’s election).

Please note that if you hold your shares in “street name”,name,” your bank, broker or other nominee will not be permitted to vote your shares on proxyProxy Item 1 (election of directors) absent specific instructions from you. Therefore, it is important that you follow the voting instructions on the form that you receive from your bank, broker or other nominee.

You may vote for or against each of the nominees for the Board of Directors, or you may abstain. If you abstain, your shares will be counted for purposes of establishing

a quorum for the

quorum,meeting, but will have no effect on the election of the nominees.

In accordance with the Company’s Corporate Governance Principles, each director nominee has submitted a contingent, irrevocable resignation that the Board of Directors may accept

ifin the

nominee fails to receiveevent that the

requiredvotes cast for the director nominee’s election do not exceed the votes cast against the director nominee’s election (with abstentions not counted as a vote

cast either for

re-election.or against the director nominee’s election). In that situation, the Corporate Governance and Nominating Committee (or a special committee consisting solely of independent directors not subject to a failed vote) would make a recommendation to the Board of Directors about whether to accept or reject the resignation, or whether to take other action. For additional information, see “Election of

Directors--2017Directors--2019 Board of Director Nominees.”

How many votes are needed to approve the other matters to be voted upon at the Annual Meeting and how will votes be counted?

The affirmative vote of the holders of a majority of shares present in person or represented by proxy at the Annual Meeting and entitled to vote is necessary for the approval of

proxyeach of Proxy Items 2,

3 and

3.5. This means that of the number of shares represented at the meeting and entitled to vote on the matter, a majority of them must be voted for the proposal for it to be approved. Proxies marked as abstentions on

proxy ItemsProxy Items 2,

3 and

35 will have the same effect as a vote against the proposal and broker non-votes will have no effect on the vote for the proposal.

The

Approval of Proxy Item 4, the amendment to our Restated Certificate of Incorporation, will require the affirmative vote

required to determine the frequency of the

advisory vote on executive compensation (Item 4) is a pluralityholders of at least 80% of the outstanding shares of our common stock, with broker non-votes and abstentions having the effect of votes

cast, which means that the frequency option that receives the most affirmative votes of all the votes cast is the one that will be deemed approved by the stockholders. Abstentions and broker non-votes will not affect the outcome ofagainst this proposal.

With respect to

theany other

mattersmatter to be voted upon, you may vote for, against or

abstain. If you abstain,

from voting for a proposal, you vote will havewith abstentions having the same effect as a vote against the proposal.

Please note that if you hold your shares in “street

name”,name,” your bank, broker or other nominee will not be permitted to vote your shares on

proxy Item 3 (advisory vote on the

compensation of our named executive officers) or proxy Item 4 (advisory vote on the frequency of holding an advisory vote on the compensation of our named executive

officers)officers (Proxy Item 3), the approval of the amendment to our Restated Certificate of Incorporation (Proxy Item 4), and the approval of the 2019 ACCO Brands Corporation Incentive Plan (Proxy Item 5) absent

specific instructions from you. Therefore, it is important that you follow the voting instructions on the form that you receive from your bank, broker or other nominee.

What if I participate in the ACCO Brands 401(k) plan?

We also are making this Proxy Statement available to and seeking voting instructions from participants in the ACCO Brands 401(k) plan who hold shares of our common stock under such plan. The trustees of the plan, as record holders of ACCO Brands common stock held in the plan, will vote whole shares attributable to you in accordance with your directions given on your voting instruction card, by telephone or through the Internet. If you hold shares of our common stock under the plan, please complete, sign and return your voting instruction card or provide voting instructions by telephone or through the Internet, as described on the voting instruction card, prior to May

11, 2017.16, 2019. The voting instruction card will serve as instructions to the plan trustees to vote the shares attributable to your interest in the manner you indicate on the card.

Important Notice Regarding the Availability of Proxy Materials for the Annual Meeting

Our Proxy Statement and 20162018 Annual Report on Form 10-K are available at: www.proxyvote.com.

Our By-laws currently provide that the Board of Directors may consist of not less than nine nor more than thirteen members. Currently, there are

eleventen members serving on our Board of Directors.

George V. Bayly and Robert H. Jenkins will retire at the Annual Meeting, following the expiration of their terms, and if all nominees are elected, the Board of Directors will consist of nine members immediately following the Annual Meeting. The Board of Directors, upon recommendation from the Corporate Governance and Nominating Committee (the “Governance Committee”), has selected all of the currently serving directors

(other than Messrs. Bayly and Jenkins) as nominees for election as directors at the Annual Meeting.

Directors are responsible for overseeing the Company’s business consistent with their fiduciary duties to stockholders. The Board of Directors believes that there are general requirements applicable to all directors as well as other skills and experience that should be represented on our Board as a whole, but not necessarily in each director. The Board of Directors and the Governance Committee consider the entirety of the qualifications of directors and director nominees individually, as well as in the broader context of the Board’s overall composition and the Company’s current and future needs.

Qualifications Required for All Directors

In assessing potential directors, including those recommended by stockholders, the Board of Directors and the Governance Committee consider a variety of factors, including the evolving needs of the Board of Directors and the Company as well as other criteria established by the Board of Directors. These include the potential director’s judgment, independence, business and educational background, stature, public service, conflicts of interest, integrity, ethics and ownership of Company stock, as well as his or her level of commitment to stockholder value creation and his or her ability and willingness to devote sufficient time to serve on the Board of Directors and to the affairs of the Company. The Board of Directors and the Governance Committee require that each director be a recognized person of high integrity with a proven record of success in his or her field.

Experience, Qualifications and Skills Represented on Our Board of Directors

In addition to the general qualifications highlighted above, in light of the Company’s current needs and its business strategy, our Board of Directors has identified particular expertise, qualifications and skills that are important to be represented on our Board as a whole. The Board of Directors believes it is valuable to have a mix of individuals with expertise as senior executives in the areas of operations, finance, marketing and sales, human resources, compensation and talent management; individuals with enterprise-level information technology expertise; and individuals with expertise in emerging market development, corporate strategy, corporate governance and risk management. The Board of Directors also believes it is important that a meaningful number of our directors have operating knowledge of the industry in which the Company operates, general management experience or experience serving as a public company director.

The Board of Directors also believes that diversity

including diverse viewpoints, is anand inclusion are important

considerationconsiderations in board composition. When considering director qualifications, the Board of Directors and the Governance Committee evaluate the entirety of each director’s credentials, including factors such as diversity of background, experience, skill, age, race, ethnicity and gender. Although the Board of Directors does not have a written diversity policy, the Governance Committee evaluates the current composition of the Board with a view toward having the Board reflect a diverse mix of skills, experiences, backgrounds and opinions. Depending on the current composition of the Board of Directors, the Governance Committee may weigh certain factors, including those relating to diversity, more or less heavily when evaluating a potential candidate.

2017

Experience, Qualifications and Skills Represented on Our Board of Directors

In addition to the general qualifications highlighted above, in light of the Company’s current needs and its business strategy, our Board of Directors has identified particular expertise, qualifications and skills that are important to be represented on our Board as a whole. The Board of Directors believes it is valuable to have a mix of individuals with expertise as senior executives in the areas of operations, finance, marketing and sales, consumer brands management, human resources, compensation and talent management; individuals with enterprise-level information technology expertise; and individuals with expertise in international market development, corporate strategy, corporate governance and risk management. The Board of Directors also believes it is important that a meaningful number of our directors have operating knowledge of the industry in which the Company operates, general management experience or experience serving as a public company director. In accordance with the Company’s Corporate Governance Principles, a director will not be nominated for election to the Board of Directors following his or her 74th birthday unless the full Board, upon the recommendation of the Governance Committee, determines that it is in the best interests of the Company and its stockholders to extend the director’s service for an additional period of time. As a group, the members of the Board of Directors reflect the diverse mix of skills, experiences, backgrounds, and perspectives that the Board believes is optimal to foster an effective decision-making environment. Of our ten director nominees, two are women, one of whom chairs our Audit Committee. Two director nominees have ethnically diverse backgrounds.

2019 Board of Director Nominees

The Board of Directors proposes that each of the

nineten nominees named and described below be elected for a one-year term expiring at the

20182020 annual meeting of stockholders or

untilwhen his or her respective successor is duly elected and qualified. Proxies cannot be voted for more than the number of nominees proposed for election.

Each of our director nominees possesses the judgment and business and educational background required and has a proven track record of success in his or her field as well as a reputation for integrity, honesty and adherence to high ethical standards. They each have business acumen and an ability to exercise sound judgment and a commitment of service to our Company, its stockholders and the Board of Directors. In addition, our

Our Board of Directors is comprised of individuals who collectively possess the particular experiences we consider important to be represented on our Board of Directors as a

whole as discussed underwhole. The table below highlights the

heading “--Experience, Qualifications and Skills Represented on Our Board of Directors” and, as a group, reflect the diverse mix of skills, experiences, backgrounds, and perspectives the Board believes is optimal to foster an effective decision-making environment. Of our nine director nominees, two are women, one of whom chairs our Audit Committee. Two director nominees (including one of the women) have ethnically diverse backgrounds.

Each of the nominees below has consented to serve a one-year term if elected. If any nominee should become unavailable to serve primary reasons each individual was selected as a director thenominee relative to our desired criteria for a diverse, well-balanced Board of Directors may designate a substitute nominee. In that case,and the persons named as proxies will vote for the substitute nominee designated by theparticular expertise, qualifications and skills we believe should be represented on our Board of Directors. Additionally, in accordance withMany of our directors have experience and expertise beyond those noted below. The table is intended to highlight the Company’s Corporate Governance Principles,specific, unique characteristics which led to each directorindividual’s selection as a nominee has submitted a contingent, irrevocable resignation that the Board may accept if the nominee fails to receive the required vote for re-election. In that situation, the Governance Committee (or a special committee consisting solely of independent directors not subject to a failed vote) would make a recommendation to the Board about whether to accept or reject the resignation, or whether to take other action. The Board would then act on this recommendation within 90 days of the date that the election results were certified, and the Company would promptly publicly disclose thecollective strength of our Board’s decision.

experience and expertise.

| | Boris Elisman | James A. Buzzard | Kathleen S. Dvorak | Pradeep Jotwani | Robert J. Keller | Thomas Kroeger | Ron Lombardi | Graciela Monteagudo | Hans Michael Norkus | E. Mark Rajkowski |

| Director Since | 2013 | 2012 | 2010 | 2014 | 2005 | 2009 | 2018 | 2016 | 2009 | 2012 |

| Age | 56 | 64 | 62 | 64 | 65 | 70 | 55 | 52 | 72 | 60 |

| Gender | M | M | F | M | M | M | M | F | M | M |

| Ethnically Diverse | | | | ✓ | | | | ✓ | | |

| Senior Operating Executive Expertise | ✓ | ✓ | | ✓ | ✓ | | ✓ | ✓ | | |

| Senior Financial Executive Expertise | | | ✓ | | | | ✓ | | | ✓ |

| Senior Marketing/Sales Executive Expertise | ✓ | ✓ | | ✓ | | | | ✓ | | |

| Senior HR/Compensation/Talent Development Expertise | | | | | | ✓ | | | | |

| Consumer Brand Expertise | | | | ✓ | | | ✓ | ✓ | ✓ | |

| Operating Knowledge of Company’s Industry | ✓ | ✓ | ✓ | | ✓ | ✓ | | | | |

| Public Company Directorship Experience | | | | ✓ | ✓ | ✓ | | | | |

| Enterprise Level Information Technology Expertise | ✓ | | ✓ | | | | ✓ | | | ✓ |

| International Market Development Expertise | ✓ | ✓ | | ✓ | | | | ✓ | ✓ | |

| Corporate Strategy Development Expertise | | | | | ✓ | | ✓ | | ✓ | ✓ |

| Corporate Governance Expertise | | | | | | ✓ | | | ✓ | |

| Risk Management Expertise | | | ✓ | | | | | | | ✓ |

The following paragraphs provide information about each director nominee’s

age,background, including positions held, principal occupation and business experience for the past five years,

the year first elected as a director of ACCO Brands and the names of other publicly traded companies for which he or she currently serves as a director or has served as a director during the past five years. For information about the number of shares of common stock beneficially owned by each director, see “Certain Information Regarding Security Holders.” There are no family relationships among any of the directors and executive officers of ACCO Brands.

The Board of Directors recommends that you vote FOR the election of all the nominees.

Boris Elisman, Chairman of the Board, President and Chief Executive Officer, Director since 2013.Officer. Mr. Elisman

age 54, is the Company’s Chairman of the Board, President and Chief Executive Officer. Mr. Elisman was appointed as Chairman of the Board in May 2016. Prior to becoming our President and CEO in March 2013, Mr. Elisman served as President and Chief Operating Officer of the Company from 2010 and was President, ACCO Brands Americas from 2008 to 2010. In 2008, he served as President of the Company’s Global Office Products Group and from 2004 to 2008, he served as President of the Company’s Computer Products Group.

James A. Buzzard, Director since 2012.Buzzard. Mr. Buzzard

age 62, served as President of MeadWestvaco Corporation,

a producer ofwhich produced packaging, specialty papers, consumer and office products, and specialty chemicals (“

MWV”MeadWestvaco”) from 2003 until his retirement in March 2014 and was responsible for global operations, including Packaging, Specialty Chemicals, Technology and Supply Chain. Mr. Buzzard began his career with Westvaco in 1978 and held positions of increasing responsibility over many years, including as Executive Vice President responsible for

MWV’sMeadWestvaco’s Consumer and Office Products Group.

Kathleen S. Dvorak Director since 2010.Ms. Dvorak, age 60, is retired. Ms. Dvorak served as Executive Vice President and Chief Financial Officer of Richardson Electronics, Ltd., a global provider of engineered solutions and a leading distributor of electronic components to the electron device marketplace from 2007 until her retirement in August 2015. Previously, she was Senior Vice President and Chief Financial Officer of

Essendant Inc. (f/k/a/ United Stationers Inc.

), an office products wholesaler and

distributordistributor. Ms. Dvorak has a certificate in Cybersecurity Oversight from

2001 until 2007.the National Association of Corporate Directors.

Pradeep Jotwani, Director since 2014. Mr. Jotwani, age 62, is a Continuing Fellow of the Distinguished Careers Institute at Stanford.Jotwani. Mr. Jotwani had a long and successful career at Hewlett-Packard Company

(“HP”) serving in a number of different capacities from 1982 to 2007 and again from 2012 until July 2015.

Among his responsibilities at HP were founding and serving as President of HP’s Consumer Business and setting up and serving as the Senior Vice President of Printing Supplies. When he retired from Hewlett-Packard in July 2015, he was

the Senior Vice President, LaserJet and Enterprise Solutions. Between

20072010 and 2012, he served as Senior Vice President

and Chief Marketing Officer at Eastman Kodak Company, which filed for bankruptcy in 2012.

In 2016 and 2017, Mr. Jotwani

served onwas a Fellow at the

board of RealNetworks from 2007 to 2010, and from 2009 until 2010 he served on the board of Westinghouse Solar.Distinguished Careers Institute at Stanford University.

Robert J. Keller, Director since 2005.Keller. Mr. Keller

age 63, served as Chairman of the Board of Directors of the Company from October 2008 until

his retirement in May 2016, and as Chief Executive Officer of the Company from October 2008 to March 2013. Prior to joining the Company, Mr. Keller served as President and Chief Executive Officer and as a director of APAC Customer Services, Inc.

from March 2004 until February 2008 and served in various capacities at Office Depot, Inc., most recently as its President, Business Services Group.

Thomas Kroeger, Director since 2009.Kroeger. Mr. Kroeger age 68 is retired. He served as President of Spencer Alexander Associates, which provided management consulting and executive recruiting services from January 2004 until his retirement in March 2017. Mr. Kroeger previously served as chief human resources officer for each of Invacare Corporation, Office Depot, Inc. and The Sherwin-Williams Company. In each of these positions he was also a member of each company’s executive committee.

Ron Lombardi. Mr. Lombardi is Chairman, President and Chief Executive Officer of Prestige Consumer Healthcare, Inc. (formerly Prestige Brands Holdings, Inc.), which markets and distributes brand-name, over-the-counter healthcare and household cleaning products throughout the United States and in certain international markets. He was elected Chairman of the Board of Prestige Brands in May 2017 and has served as a director and as President and Chief Executive Officer since June 2015. Prior to this role, Mr. Lombardi served as Prestige Brands’ Chief Financial Officer from December 2010 until November 2015.

Graciela Monteagudo, Director since 2016.Monteagudo. Ms. Monteagudo

age 50, isserved as Chief Executive Officer of LALA U.S., a dairy company focused on manufacturing and selling drinkable yogurts and value-added specialty

milks.milks from March 2017 to December 2018. Ms. Monteagudo

previously served as Senior Vice President and President, Americas for Mead Johnson Nutrition Company from July 2015 to February 2017 where she was responsible for Mead Johnson’s businesses in North America and Latin America. Between May 2012 and June 2015, Ms. Monteagudo served as Mead Johnson’s Senior Vice President and General Manager, North America and Global Marketing.

Prior to that, Ms. Monteagudo served in several capacities for Walmart Mexico, most recently as Senior Vice President and Business Unit Head, Sam’s

Club from 2010 to 2012.Club.

Hans Michael Norkus, Director since 2009.Norkus. Mr. Norkus age 70, has served as President of Alliance Consulting Group, a business strategy consulting firm since April 1986. Prior to founding Alliance Consulting Group, in 1986, Mr. Norkus was Vice President and director of The Boston Consulting Group, where he served for 11 years. Mr. Norkus also currently servesserved as a director of Genesee & Wyoming, Inc. and served as a director of Overland Storage, Inc. from 2004 to 2011.until May 2018.

E. Mark Rajkowski, Director since 2012.Rajkowski. Mr. Rajkowski

age 58, has served as Senior Vice President and Chief Financial Officer of Xylem Inc., a global water technology company, since March 2016. Mr. Rajkowski served as Senior Vice President and Chief Financial Officer of

MWVMeadWestvaco from 2004 until July 2015. He began his career with PricewaterhouseCoopers LLP in 1981, last serving as the managing partner for the Upstate New York Technology Industry Group, and held financial and operating positions of increasing responsibility at Eastman Kodak Company prior to joining

MWV.The table below highlightsMeadWestvaco.

Each of our director nominees possesses the primary reasonsjudgment and business and educational background required, has a proven track record of success in his or her field as well as a reputation for integrity, honesty and adherence to high ethical standards. They each individual was selectedhave business acumen, an ability to exercise sound judgment and a commitment of service to our Company, its stockholders and the Board of Directors.

Each of the director nominees has consented to serve a one-year term if elected. If any director nominee should become unavailable to serve as a director,

nominee relative to our desired criteria for a diverse, well-balancedthe Board of Directors

andmay designate a substitute nominee. In that case, the

particular expertise, qualifications and skills we believe should be represented on ourpersons named as proxies will vote for the substitute nominee designated by the Board of Directors.

Many of our directors have experience and expertise beyond those noted below. The table is intended to highlightAdditionally, in accordance with the

specific, unique characteristics which led toCompany’s Corporate Governance Principles, each

individual’s selectiondirector nominee has submitted a contingent, irrevocable resignation that the Board may accept in the event that the votes cast for the director nominee’s election do not exceed the votes cast against the director nominee’s election (with abstentions not counted as a

nominee.vote cast either for or against the director nominee’s election). In that event, the Governance Committee (or a special committee consisting solely of independent directors not subject to a failed vote) would make a recommendation to the Board about whether to accept or reject the resignation, or whether to take other action. The Board would then act on this recommendation within 90 days of the date that the election results were certified, and the Company would promptly publicly disclose the Board’s decision.

During

2016,2018, there were seven meetings of the Board of Directors. Each director attended more than 75% of the total number of meetings of the Board of Directors and the committees of the Board of Directors on which such director served. In addition to participation at Board of Directors and committee meetings, our directors discharged their responsibilities throughout the year

through personal meetings and other communications, including considerable telephone contact with our Chairman and CEO and other members of senior management regarding matters of interest and concern to ACCO Brands.

The Board of Directors has adopted Corporate Governance Principles to assist it in the exercise of its responsibility to oversee the performance of the Company’s management for the benefit of the Company’s stockholders and the creation of stockholder value. These principles, along with the charters of the Board of Directors’ committees and other key policies and practices of the Board of Directors, are intended to provide a framework for the governance of the Company.

The Corporate Governance Principles provide that a majority of the members of the Board of Directors, and each member of the Audit, Compensation, and Governance Committees, must meet certain criteria for independence. Based on the NYSE independence requirements, the Corporate Governance Principles (which are available on our website, www.accobrands.com) set forth certain standards to assist the Board of Directors in determining director independence. The Corporate Governance Principles provide that a director will be considered independent only if the Board of Directors affirmatively determines that the director has no material relationship with the Company, either directly or as a partner, stockholder or officer of an organization that has a relationship with the Company. In addition, the Corporate Governance Principles provide that under no circumstances will a director be considered independent if:

| (a) | the director is a current employee of the Company or any of its subsidiaries, or has an immediate family member who is a current executive officer of the Company or any of its subsidiaries; |

| (b) | the director is a former employee, or any immediate family member is a former executive officer, of the Company or its subsidiaries, until three years after the employment has ended; |

| (c) | the director (1) is a current partner or employee of the firm that is the Company’s internal or external auditor; (2) has been within the last three years, or has an immediate family member that has been within the last three years, a partner or employee of such firm and worked on the Company’s audit during that time; or (3) has an immediate family member who is currently, or within the last three years has been, an employee of such firm and participates in the audit, assurance or tax compliance (but not tax planning) practice; |

| (d) | the director or an immediate family member has been within the last three years employed as an executive officer of another company where any of the Company’s present executive officers serves or has served at the same time on that company’s compensation committee; |

| (e) | in any year, the director or any immediate family member receives, or in any twelve-month period within the last three years has received, more than $120,000 in direct compensation from the Company, other than director and committee fees and pension or other forms of deferred compensation for prior service (provided such compensation is not contingent in any way on future service); and |

| (f) | the director is a current employee, or any immediate family member is a current executive officer, of a company that makes payments to, or receives payments from, the Company for property or services in an amount that exceeds, in any of the last three fiscal years, the greater of $1 million or 2% of the other company’s consolidated gross revenues. |

Each currently serving member of the Board of Directors, other than

Messrs.Mr. Elisman,

and Keller, has been affirmatively determined by the Board of Directors to be independent as defined in the Corporate Governance Principles and in accordance with NYSE independence requirements.

Mr. Jenkins currently servesKeller previously was not considered independent as he had served as our Presiding Independent Director. The BoardExecutive Chairman. Effective March 13, 2018, the third anniversary of Directors intendshis retirement from that position, Mr. Keller was determined to appoint a new Presiding Independent Director immediately following Mr. Jenkins’ retirement atbe independent according to the Annual Meeting. The Presiding Independent Director presides at all executive sessionsindependence requirements of the non-employee directors. Executive sessions of non-employee directors are held at every regularly scheduled meeting of the Board of Directors. In 2016, each regularly scheduled Board meeting included a non-employee director executive session, which for certain sessions only the independent directors of the Board attended.

NYSE and our Corporate Governance Principles.

Stockholder Communication

The Board of Directors and management encourage communication from our stockholders. Stockholders who wish to communicate with our management should direct their communication to the Chairman or the Office of the Corporate Secretary, Four Corporate Drive, Lake Zurich, Illinois 60047. Stockholders and other interested parties who wish to communicate with the non-employee or independent directors, any individual director or the

PresidingLead Independent Director should direct their

communication care of the Office of the Corporate Secretary at the address above. The Corporate Secretary will forward to our PresidingLead Independent Director any communications intended for the full Board of Directors, for the non-employee or independent directors as a group, or for the PresidingLead Independent Director. Communications intended for an individual director will be forwarded directly to that director. If multiple communications are received on a similar topic, the Corporate Secretary may, in her discretion, forward only representative correspondence. Any communications that are unrelated to the Company or Board business or that are abusive, inappropriate or in bad taste or present safety, security or privacy concerns may be handled differently.

Annual Meeting Attendance

We do not have a formal policy requiring members of the Board of Directors to attend stockholders’ annual meetings, although all directors are expected to attend.

EightAll of the

ten directorsdirector nominees serving on the Board of Directors at the time of the

20162018 annual meeting of stockholders attended the

20162018 annual meeting.

Board of Directors’ Leadership Structure

Chairman and CEO

The Board of Directors regularly evaluates whether it is in the best interests of the Company for the positions of Chairman and CEO to be separate or combined. In

connection with the appointment of Mr. Elisman as our CEO in March 2013, the role of Chairman and CEO was split, with Mr. Keller continuing to serve as Executive Chairman and, after March 2015, as non-executive Chairman. Among other reasons, separating the role of Chairman and CEO in March 2013 was intended to enable Mr. Elisman to focus his attention on his responsibilities as CEO during his early years in the position, while Mr. Keller’s continued role as Chairman would provide continuity in leadership of the Board of Directors and support a smooth transition of executive leadership of the Company.In May 2016, it was determined to again combine the roles of Chairman and CEO, and Mr. Elisman, our CEO, was appointed Chairman. The decision to combine the roles reflectsreflected the successful full transition of the Company’s leadership to Mr. Elisman during the three years since he first assumed the position of CEO. We believe that having a single leader for the Company is advisable in order to convey to our customers, business partners, investors and the other stakeholders strong, unified leadership.

Although

Lead Independent Director

Mr. Elisman’s role as both the roles of Chairman and CEO have been combined, Mr. Elisman’s dual role is appropriately balanced by the role of the PresidingLead Independent Director, who presides at meetings of all non-employee directors in executive session. This allows directors to speak candidly on any matter of interest, without the Chairman and CEO or other members of management present. The PresidingLead Independent Director works closely with Mr. Elisman in establishing the agenda for each meeting of the Board of Directors and acts as a conduit for contact between Mr. Elisman and the other directors. The Presiding

Mr. Buzzard currently serves as our Lead Independent

Director, although not required to do so, also endeavors to attend as manyDirector. Executive sessions of non-employee directors are held at every regularly scheduled meeting of the Board

committee meetings as possible.of Directors. In 2018, each regularly scheduled Board meeting included a non-employee director executive session.

Independent Committee Structure

Further,

it is ourwe view

that the independent members of our Board of Directors and the four standing Board committees

provideas providing appropriate oversight and

an effectivefurther balance to the combined Chairman and CEO role. For additional information regarding the roles and responsibilities of our Audit Committee, Compensation Committee, Governance Committee, and Finance and Planning Committee (the “Finance Committee”), see

“--Committees.“Committees.” The Chairman and CEO does not serve on any of our standing committees and, as discussed in more detail below, the entire Board of Directors is actively involved in overseeing our risk management. We believe the independent composition of our principal Board committees, together with the

PresidingLead Independent Director, provides balanced leadership and consistent, effective oversight of our management and our Company.

Our Board of Directors believes that an effective enterprise risk management program (“ERM”) will identify in a timely manner the material risks we face, and communicate necessary information about those risks to senior management and, as appropriate, to the Board of Directors or its relevant committees. Additionally, our Board of Directors believes an effective ERM will support the implementation of appropriate and responsive risk management strategies, and integrate risk management into our decision-making. Our senior management has primary responsibility for managing enterprise risks as well as the day-to-day risks associated with our business, including strategic, operational, financial, legal, regulatory, technology,

environmental, social, geo-political, reputational, and emerging risks.

Our Board is responsible for the oversight of our risk management. Our ERM includes

policies and procedures designed to help identify, evaluate, monitor, manage and mitigate the major internal and external risks we are exposed to in our business and to align risk-taking appropriately with our efforts to increase stockholder value. The Board currently oversees our risk management primarily

thoroughthrough the Governance Committee which oversees the ERM

policies and procedures established by management and the delegation of specific areas of risk to other Board committees, as well as through the Audit Committee which receives regular reports from the Company’s Vice President of Internal Audit and its General Counsel. Our Board receives regular reports from

each Board committee regarding topics discussed at the committee meetings, which include the areas of risk overseen by the committees.

| ● | Governance Committee:In addition to overseeing our ERM policies and procedures, our Governance Committee is responsible for reviewing management’s activities in the areas of product liability/safety, and anti-corruption and bribery. Our Governance Committee also oversees management’s administration of the Company’s corporate social responsibility and sustainability programs and periodically reviews the structure of our Board’s committees and charters to ensure appropriate oversight of risk. |

| ● | Audit Committee:Our Audit Committee oversees certain financial risks associated with the preparation of the Company’s financial statements and our financial compliance activities, including the adequacy of our internal controls over financial reporting, our disclosure controls and procedures and our information technology general controls. The Audit Committee also oversees management actions and controls related to cyber and data security risks, disaster recovery and business continuity. |

| ● | Finance Committee:Our Finance Committee assists in monitoring and overseeing financial risks with respect to the Company’s capital structure, investments, use of derivatives and hedging instruments, currency exposure and other business and financing plans and policies. |

| ● | Compensation Committee:Our Compensation Committee considers risk and structures our executive compensation programs with an eye to providing incentives to appropriately reward executives for growing stockholder value without undue risk taking. It reviews, at least annually, the relationship between the Company’s ERM, corporate strategy and executive compensation. See “Compensation Discussion and Analysis--Discussion and Analysis--Role of our Compensation Committee and Management.” Oversight of the Company’s succession planning also is included in the Compensation Committee’s risk oversight responsibilities. |

Governance Committee: In addition to overseeing our ERM procedures, our Governance Committee also oversees management’s administration of the Company’s corporate social responsibility and environmental sustainability programs, corporate governance policies and practices, including anti-corruption and bribery, and product safety, and periodically reviews the structure of our Board’s committees and charters to ensure appropriate oversight of risk.

Audit Committee: Our Audit Committee oversees the financial risks associated with the preparation of the Company’s financial statements and our financial compliance activities, including the adequacy of our internal controls over financial reporting, our disclosure controls and procedures and our information technology general controls. The Audit Committee also oversees management actions and controls related to cyber and data security risks, disaster recovery and business continuity.

Finance Committee: Our Finance Committee assists in monitoring and overseeing financial risks with respect to the Company’s capital structure, investments, use of derivatives and hedging instruments, currency exposure and other business and financing plans and policies.

Compensation Committee: Our Compensation Committee considers risk and structures our executive compensation programs with an eye to providing incentives to appropriately reward executives for growing stockholder value without undue risk taking. It reviews, at least annually, the relationship between the Company’s ERM and corporate strategy and executive compensation. See “Compensation Discussion and Analysis--Discussion and Analysis--Compensation Risk Assessment.” Oversight of the Company’s succession planning and management development is also handled by the Compensation Committee.

In addition to the activities undertaken by each of the Board committees, the Board as a whole participates in regular discussions among directors and with senior management with respect to several core subjects in which risk oversight is an inherent element, including strategy, operations, finance, mergers and acquisitions and legal

compliance matters. Operational and strategic presentations to the Board include consideration of the challenges and risks to our business. At least annually, our Board reviews management’s long-term strategic plans and the risks associated with carrying out these plans.

The Board of Directors has established an Audit Committee, a Compensation Committee, a Governance Committee and a Finance Committee, each of which operates pursuant to a written charter that is available on our website (www.accobrands.com). The Company also has an Executive Committee that consists of Messrs. ElismanNorkus (Chairperson), Elisman, Keller and Jenkins.Buzzard. The Executive Committee has all the power and authority of the Board of Directors except for specific powers that by law must be exercised by the entire Board of Directors. Although Messrs. Buzzard and Rajkowski are independent under our Corporate Governance Principles and the NYSE standards, neither of them currently serve on the Compensation Committee, Governance Committee or

Audit Committee

as an acknowledgment that some third parties may not consider them independent for a period of time due to their employment with MWV at the time of the Company’s acquisition of the consumer and office products business of MWV in May 2012. Beginning May 2017, we believe a sufficient amount of time will have passed since the Company’s acquisition of MWV’s consumer and office products business to alleviate such independence concerns, which would enable the Board to consider Messrs. Buzzard and Rajkowski for appointment to the Compensation, Governance or Audit Committees in the future.Audit Committee

| Members | The members of the Audit Committee are Ms. Dvorak (Chairperson), Mr. Jotwani,Lombardi, and Mr. Jenkins and Ms. Monteagudo, who joined the Audit Committee upon her election to the Board in August 2016.Rajkowski. Each member meets the independence standards of our Corporate Governance Principles and the NYSE and the independence standards under Rule 10A-310A‑3 under the Securities Exchange Act of 1934, as amended (the “Exchange Act”). Each member meets the financial literacy requirements of the NYSE and Ms. Dvorak and Messrs. Jotwani and Jenkins havehas been determined by the Board of Directors to be “audit committee financial experts” as defined in Item 407(d)(5)(ii) of Regulation S-KS‑K under the Exchange Act. |

| Number of Meetings Last Year | TenEleven |

| Primary Functions | Oversees (1) the integrity of our financial statements and our accounting and financial reporting processes, (2) the independence and qualifications of our independent auditors, (3) the performance of the independent auditors and our internal audit function, and (4) our compliance with legal and regulatory requirements.requirements not specifically delegated to other Board committees. As part of its responsibilities, the Audit Committee, among other things: |

| ● | retains and oversees an independent, registered public accounting firm to serve as the Company’s independent auditors to audit our financial statements and monitors the independence and performance of our independent auditors; |

| ● | approves the scope of audit work and reviews reports and recommendations of our independent auditors; |

| ● | meets separately with our independent auditors on a quarterly basis; |

| ● | reviews the annual internal audit plan, summaries of key reports and updates on the results of internal audit work; |

| ● | reviews internal audit staffing levels, qualifications and annual expense budgets; |

| ● | pre-approves all audit and permissible non-audit services to be provided by our independent auditors in accordance with policies and procedures established and maintained by the Audit Committee; |

| ● | reviews and discusses with management our financial statements and quarterly and annual reports to be filed with the SEC, our earnings announcements and related materials; |

| ● | reviews and discusses with management the adequacy and effectiveness of our disclosure controls and procedures and our internal control over financial reporting, including any material weaknesses, significant deficiencies or changes in internal controls; |

| ● | discusses with our independent auditors our annual and quarterly financial statements; |

| ● | reviews our policies regarding financial risk assessment and risk management and discusses with management the Company’s financial risk exposures and actions taken to monitor and control such exposures; |